Bitcoin Price and Ethereum Prediction: Can BTC and ETH Bounce Back From Double Bottom Support Levels?

Crypto markets have seen huge swings over the past few weeks, with Bitcoin and Ethereum prices suddenly increasing and decreasing. This has been a turbulent time for investors in the digital currency space.

On Monday, Bitcoin (BTC) saw its value plummet to below $23,000 as investors waited to hear from Jerome Powell, Federal Reserve Chairman. Other digital assets, such as Ethereum, were also flat, with BTC falling by 2.05% and ETH dropping by 2.36%.

The major influencers in the cost of Bitcoin and other assets were an increase in fear surrounding the pandemic and a choppy crypto market. The combination of these elements has resulted in heightened trading activity with digital currencies.

The US dollar's bullishness has had a considerable impact on the crypto space, adding to the crypto market's struggles and causing a cessation of the crypto boom.

Recently, many negative factors have led to a decline in the cryptocurrency market. These include heightened worries about potential currency tightening and resistance from Sri Lanka against the use of bitcoin.

Moving forward, traders are being extra cautious when it comes to investing due to the upcoming conversation between Federal Reserve Chairman Jerome Powell and the Economic Club of Washington D.C on Tuesday. The conversation is expected to provide investors with new insights into the economic landscape. Close attention will be paid to comments regarding the inflation path and the most recent labor figures.

Bullish US Dollar Damps The Crypto Market's Bull Run - Where To Now?

The global crypto market failed to sustain its previous week's upward rally and turned bearish on Monday. The BTC prices decreased by 2.5% as the labor market report determined that US job opportunities had grown more than expected in January.

This created uncertainty around the Fed's decision to lift up the interest rates, thus having a negative effect on crypto prices.

Many cryptocurrencies saw a decline over the weekend, following the decline in US equities brought on by Friday's surprise increase in employment growth figures. Thereby, the concerns about expected interest rate hikes have increased, which ultimately put bearish pressure on the crypto market.

Investors are still waiting and watching as they anticipate the Fed chairman's remarks this week. The head of the US Fed has stated that more aggressive policy action is anticipated going forward in the fight against inflation.

Last week, the Fed increased interest rates as predicted and indicated that it will do so again soon; it is worth recalling. Moving forward, markets are anticipating more economic clues from Chair Jerome Powell's speech at the Economic Club of Washington, D.C. on Tuesday.

Moreover, they will keep a close eye on any remarks made about the trajectory of inflation and the most recent labor data.

What You Need To Know About Bitcoin In Sri Lanka

Nandalal Weerasinghe, the Governor of the Central Bank, believes that the adoption of decentralized cryptocurrencies will worsen the nation's economic condition. American millionaire Tim Draper recently traveled to Sri Lanka and proposed using Bitcoin as a legal tender to combat the corruption that caused the island nation's hyperinflation.

During a TV shoot in Sri Lanka, Draper met with President Ranil Wickremesinghe and Weerasinghe to suggest Bitcoin as a practical solution for solving financial issues.

Nandalal Weerasinghe, the Governor of the Central Bank of Sri Lanka - a major authority figure - thought that doing so would aggravate the economic condition of the nation. Consequently, this news has had no significant impact on Bitcoin prices thus far.

Bitcoin Price

As of today, the value of Bitcoin is $22,877. Over the last 24 hours, its trading volume was $21.8B and it decreased by 2.17%. It currently ranks first in terms of market cap with a worth of $441B .

In recent times, Bitcoin has been experiencing a downward trend and is currently hovering around the support level of $22,700. If it breaches this level, further loss in the price is expected and it might eventually settle at $22,400, which is highlighted by a rising trendline and can be seen as a potential point of support.

Technical analysis using tools like RSI and MACD have presented signs of a possible uptick in selling pressure that could subsequently lead to the value of BTC dropping to $22,350 as its next lowest point.

According to the 50-day exponential moving average, BTC/USD may face resistance near the $23,250 level and under this selling, the trend remains strong. If it gets over the $23,250 mark, it could potentially reach the $23,500 level. This suggests that an increase in value is likely.

Ethereum Price

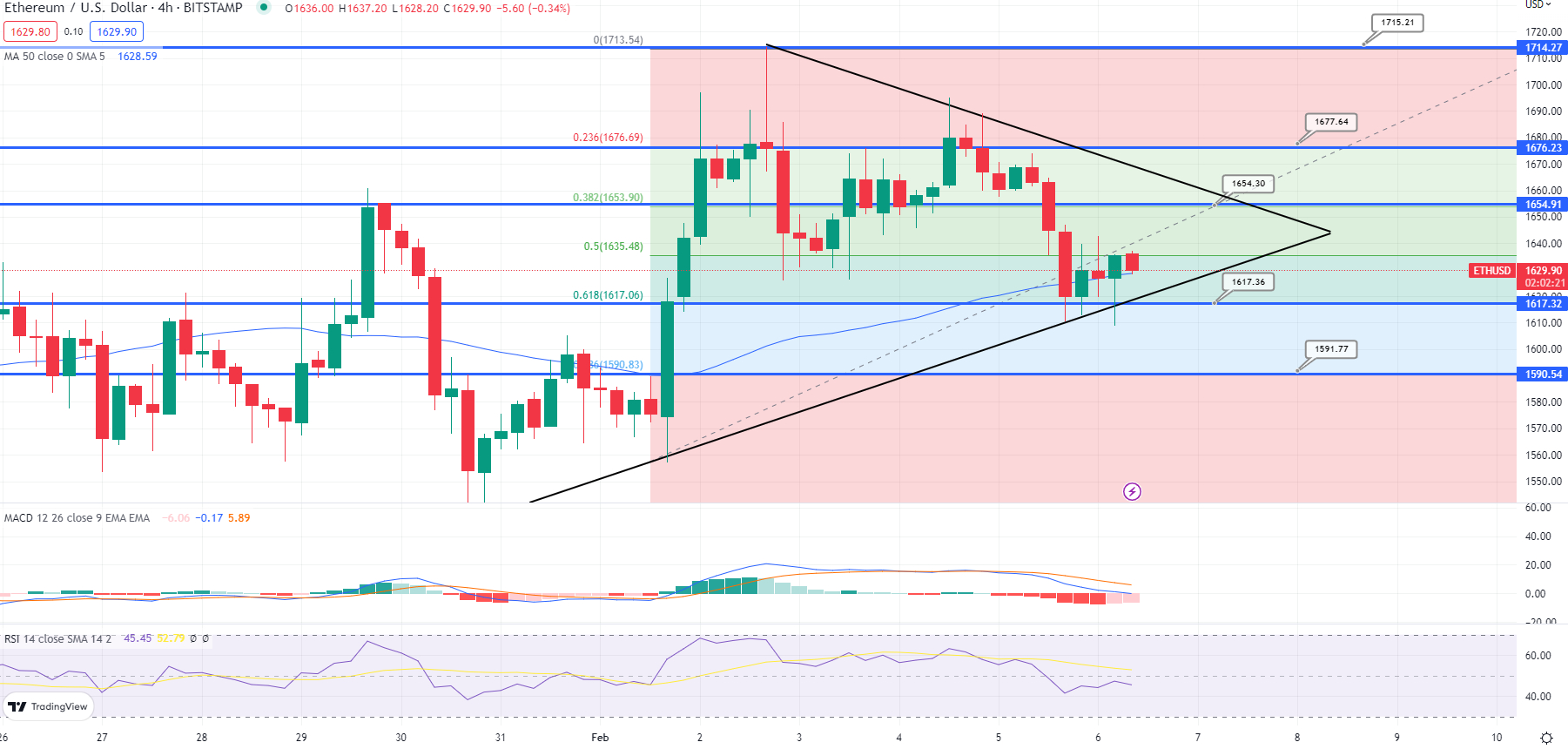

Currently, Ethereum is trading at $1,633 and has seen a decline of 2.02% in the last 24 hours. The 24-hour trading volume is $7.5 billion and it holds 2nd position by market capitalization with a live market cap of $199 billion as per CoinMarketCap rankings.

The ETH/USD pair has not seen a significant change in its rate over the past few days and is trading within the range of $1,610 to $1,650. If this level is surpassed, ETH price may surge up to $1,720.

The Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) indicators have provided conflicting signals recently, which may mean that the trend is about to change. One suggests buying, while the other hints at selling.

The 50-day Exponential Moving Average has indicated a possible bullish trend for cryptocurrencies. Values above $1,620 suggest that there could be an increase in coin prices.

Bitcoin and Ethereum Alternatives

CryptoNews Industry Talk recently identified the top 15 cryptocurrencies for 2023. If you're aiming to invest in something more promising, there are many other options that you can explore.

On a weekly basis, the number of available cryptocurrencies and new ICOs (Initial Coin Offerings) continues to rise.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

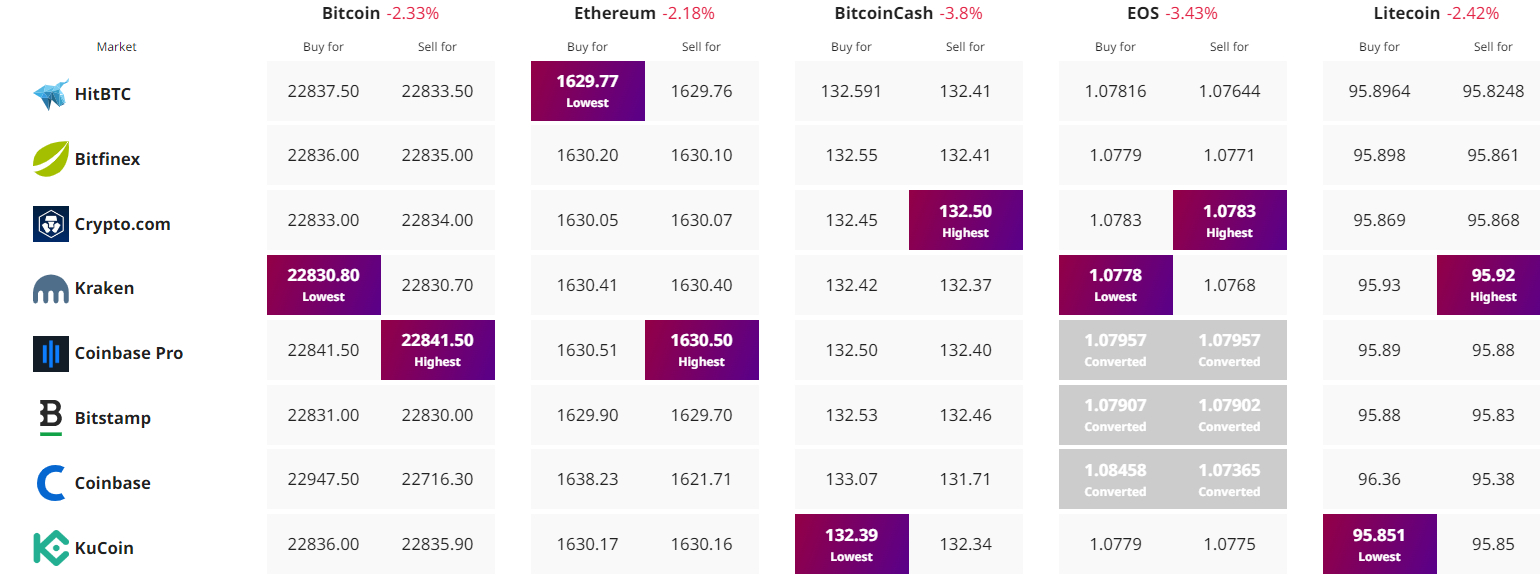

Find The Best Price to Buy/Sell Cryptocurrency